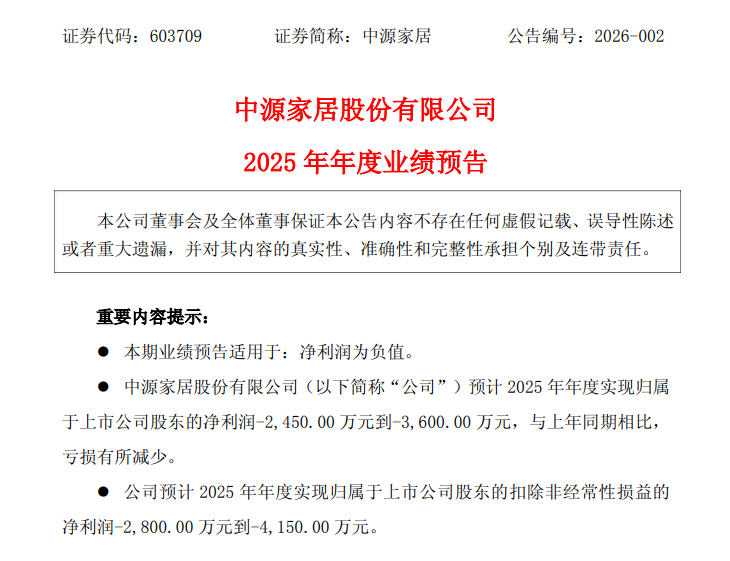

Recently, Zhongyuan Home Furnishings released its 2025 annual performance forecast, expecting a net loss attributable to the parent company of RMB 24.5 million to RMB 36 million, a narrowing of 14%-41% compared to the loss of RMB 41.739 million in the same period last year. Although it has not yet turned a profit, the significant reduction in losses indicates that the company's cross-border e-commerce strategy is gradually paying off.

Zhongyuan Home Furnishings was established in 2001, headquartered in "China's Bamboo Town" - Anji, Zhejiang. It strategically transformed into the functional sofa field in 2008 and was listed on the main board of the Shanghai Stock Exchange in 2018. The company's products cover functional sofas, fixed sofas, panel furniture, etc., with exports accounting for over 95% of total sales, and its market spans across the United States, Europe, Japan, Australia, and other regions.

In recent years, the company has regarded cross-border e-commerce as the core lever for transforming from OEM processing to OBM (Original Brand Manufacturer) independent brands. In the first half of 2024, its cross-border e-commerce business grew by 55.35% year-on-year, gradually becoming the largest business segment.

To support the development of cross-border e-commerce, the company continues to invest heavily in the construction of overseas warehouses. In September 2023, it spent RMB 74.598 million to lease a 17,300 square meter overseas warehouse in Chino, California, aiming to improve the delivery timeliness and customer experience of large furniture items. In terms of channel layout, while consolidating traditional advantageous platforms such as Amazon and Wayfair, the company actively enters emerging channels such as TEMU and TikTok Shop, forming a diversified sales matrix. On the supply chain side, since 2022, it has promoted the construction of a manufacturing base in Vietnam, attempting to hedge against the risks of US tariff policies through capacity transfer.

However, the pain of transformation is still evident. The performance forecast shows that although the scale of the cross-border e-commerce business has grown, due to macroeconomic fluctuations and frequent adjustments to tariff policies, the effectiveness of cost control has not fully offset the pressure; the traditional foreign trade business is facing the dilemma of rising comprehensive export costs and phased order contractions. In the first three quarters of 2024, the company's revenue increased by 50.51% year-on-year, but the net profit attributable to the parent company decreased by more than 90%, highlighting the phenomenon of "increased revenue but not profit", reflecting the scissors difference between scale expansion and profitability that has not yet been bridged.

Today, Zhongyuan Home Furnishings regards "cost reduction and efficiency enhancement" as its core goal, planning to optimize the supply chain through data-based means, lock in logistics costs, improve sales turnover rates, and implement differentiated operation strategies for different platforms. From OEM going overseas to brand going overseas, from capacity expansion to lean operation, Zhongyuan Home Furnishings' transformation path is still in deep waters. Whether it can achieve a turning point from scale growth to profit release is worth continuous market attention.

Cross-border e-commerce Hugo.com

Cross-border e-commerce Hugo.com