After struggling to survive, can Allbirds truly break out of its predicament by returning to online sales?

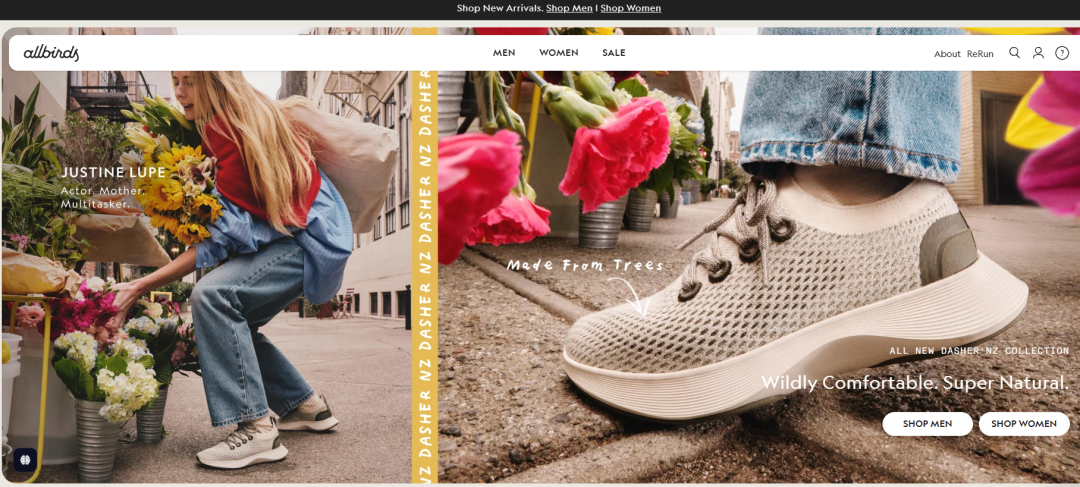

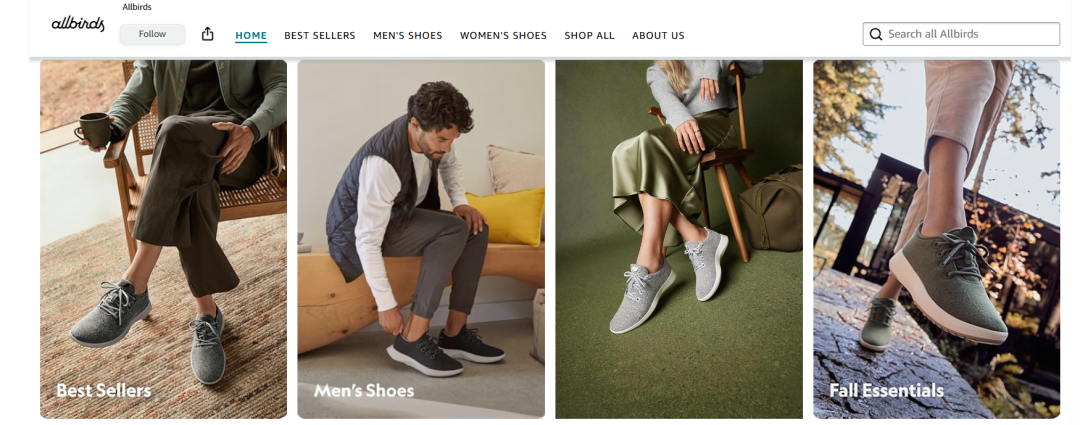

Recently, Allbirds, an eco-friendly footwear brand that gained fame in Silicon Valley and globally with its wool shoes and was dubbed "the world's most comfortable shoes," officially announced that it will close all its brick-and-mortar retail stores in the US market by the end of February, focusing resources on e-commerce and cooperative channels.The brand, which started with a Direct-to-Consumer (DTC) model, quickly became popular due to its unique positioning and successfully went public in 2021, with a market value once reaching $4.1 billion. Over the past two years, Allbirds has gradually reduced the scale of its physical stores, closing unprofitable stores to reduce costs and ensure the long-term healthy development of the business. Allbirds CEO Joe Weinberg stated that this transformation is an important step for the company to achieve profitable growth. The rise of Allbirds can be regarded as a textbook case for the development of DTC brands. In 2016, Allbirds' official website was launched, and a simply designed wool sneaker stood out in the highly competitive footwear market. This product, with its high performance and ultimate comfort, quickly earned the title of "the world's most comfortable shoe." In addition to the product's own advantages, Allbirds also accurately captured the wave of sustainable consumption, making "environmental protection" a core differentiating selling point. The brand's raw materials are all made from natural renewable resources, and it innovatively labels the carbon footprint on the product information of each pair of shoes, making the concept of environmental protection tangible and visible. During the development boom of the DTC model, Allbirds decisively bypassed traditional wholesale channels, connecting directly with consumers through its official website, reducing costs associated with intermediaries and establishing deep communication with users, quickly accumulating brand awareness and a loyal customer base. The brand also gained many supporters in the Silicon Valley circle, and even The New York Times wrote an article evaluating "this closed world has chosen Allbirds." Silicon Valley giants such as Google co-founder Larry Page and former Twitter CEO Dick Costolo are loyal users of Allbirds. Hollywood superstar Leonardo DiCaprio not only collected multiple styles of the brand but also made strategic investments in it. In 2018, Allbirds achieved a key development milestone: global sales officially exceeded 1 million pairs, and in December of the same year, it completed $77.5 million in financing, with the brand valuation soaring to $1.4 billion, successfully entering the unicorn enterprise ranks. In November 2021, Allbirds went public on NASDAQ, with its stock price surging over 90% on the first day of listing, and the market value once exceeded $4.1 billion. However, the glory days were short-lived. As the pandemic dividends gradually dissipated, the global consumption environment continued to tighten, and industry competition intensified, Allbirds' growth story began to show cracks. Similar to many rapidly rising DTC brands, after achieving initial success, Allbirds embarked on a large-scale expansion: on one hand, it opened dozens of physical stores in core business districts of major cities, aggressively deploying an offline retail network; at the same time, it expanded its product line, launching some clothing categories that did not match the core product line of Allbirds, such as tights, jackets, and high-performance running shoes. However, behind the offline expansion was the heavy financial burden brought by high operating costs. Rent, labor, and store operations costs continued to rise, while the sales performance of offline stores was far below expectations, resulting in a serious imbalance between input and output. The brand's third-quarter financial report released last November showed that its net revenue from US offline stores decreased by about 20% year-on-year, making offline business a performance shortcoming for the brand. Industry insiders pointed out that the core advantage of DTC brands lies in precise social media marketing and strong control over online channels. When such brands expand into physical retail, they often underestimate the complexity and cost structure of offline operations and lack mature offline operation experience, eventually making offline business a development burden. In addition to the misalignment of strategic expansion, insufficient product innovation capability is also an important reason for Allbirds' weak growth. Although the brand later launched new products such as eucalyptus fiber sneakers and trail running shoes, its core revenue still highly depends on the initial wool shoe style. At the same time, the intensifying industry competition also diverted the brand's core market share, with many emerging eco-friendly footwear brands entering the market, dividing the market with differentiated positioning, gradually weakening Allbirds' brand advantages. Nearly five years later, to save its persistently low profitability, Allbirds chose to refocus on e-commerce channels and return to its DTC core model, attempting to reverse its development decline. When Allbirds closed all its offline stores in the US, many people's first reaction was: Is it because offline sales are not working, and they have to return to online sales to survive? But if you look at the long-term perspective, you will find that Allbirds has been a brand that "relies on online sales" from day one. As early as the data disclosed before going public, more than 80% of Allbirds' sales came from online channels, and offline stores were more for experience, exposure, and brand endorsement, not the main money-making machines. In other words, closing stores is not a "transformation," but rather putting resources back into their most familiar and important main battlefield. But the problem is: although online has always been the main channel, it does not mean it is easy to do. According to its latest financial report, in Q3 of 2025, the company's net revenue was $33 million, a year-on-year decline of 23.3%, and gross margin was also declining, still in a loss state. This shows a realistic problem: even if offline costs are cut, relying solely on online sales does not automatically restore growth. The bigger challenge comes from changes in the entire DTC industry environment. Traffic is getting more expensive, user attention is more scattered, and consumers are no longer easily buying "concept brands," but care more about cost-effectiveness, experience, and real value. Currently, the independent website is still the core of Allbirds' entire e-commerce field. It not only carries transaction functions but is also the main position for brand value, product stories, and user relationship precipitation. According to similarweb data, the total monthly visits to its independent website remain around 2 million, of which direct access and natural search account for about 70%, while paid search only accounts for 6%, meaning its online traffic structure is still mainly based on brand awareness and natural acquisition, rather than relying on continuous burning of money for traffic. But this does not equate to "the online foundation is solid." From the perspective of conversion and retention, Allbirds faces a more structural problem: the differentiation established by the brand in the early days through "eco-friendly materials + comfortable experience + DTC narrative" is difficult to continue to constitute a strong purchase drive in the current highly homogenized and price-sensitive consumption environment. Traffic is still there, but sales ability and user repurchase are under pressure.Traffic is still there, but sales ability and user repurchase are under pressure. In the face of declining sales, Allbirds has been trying to strengthen website experience and membership marketing since last year. For example, by optimizing email marketing, in-site personalized recommendations, etc., to improve the repurchase rate of old users and make it easier for "first-time visitors" to complete their first order. This is a common practice for DTC e-commerce after the disappearance of traffic dividends and is often regarded by industry analysts as a key step in "improving the quality of online operations." In addition, Allbirds also tries to alleviate this challenge through channels outside the official website, such as cooperating with Amazon and other platforms outside the official website and continuing to expand wholesale channels to find new traffic pools. In fact, as early as November 2023, Allbirds began selling core products on Amazon, including Tree Runners, Tree Breezers, and other shoe styles officially landing on the Amazon platform, and has accumulated thousands of comments, with ratings all above 4.2 stars, indicating that its products still have a certain reputation on mainstream e-commerce platforms. But entering Amazon does not mean immediate growth. Compared to independent websites, platform channels have more intense competition, higher price transparency, and also mean greater promotional pressure and lower gross margins. In other words, what Allbirds gets with "easier to be found" is "harder to maintain profits." This step is more like a realistic compromise rather than an ideal growth shortcut. At the same time, Allbirds is also continuing to promote the layout of wholesale and cooperative retail channels. According to the company's financial report, its wholesale channels have covered mainstream US retailers including REI, Nordstrom, Dick's Sporting Goods, etc. Compared to direct e-commerce, wholesale channels are more helpful to expand coverage and reduce customer acquisition costs, but also face problems such as compressed profits and reduced brand controllability. From the perspective of channel structure, Allbirds is currently forming an online system of "walking on three legs": independent websites are responsible for precipitating brand awareness and high-value users; platform e-commerce is responsible for acquiring new customers and traffic exposure; wholesale retail assumes the function of scale distribution and inventory digestion. But the reality is that all three paths

Cross-border e-commerce Hugo.com

Cross-border e-commerce Hugo.com