Customs declaration logic is changing again.

1. According to customs notice,9810declaration prohibits the use of platform sale prices

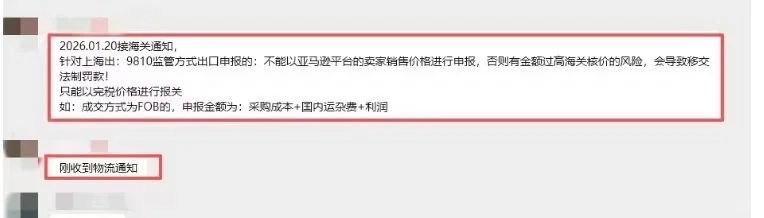

It is rumored that freight forwarders in Shanghai have received customs notices one after another that exports declared by 9810 method cannot use the sales prices of platforms such as Amazon. Otherwise, they may be subject to customs price verification due to excessively high amounts and face fines for legal transfer. The declaration must adopt duty-paid price, that is, purchase cost + domestic transportation and handling fees + reasonable profit. Cross-border e-commerce exports need to achieve full-link consistency such as invoices and customs declarations. Mismatch between sale price declaration and purchase invoice does not meet the requirements for regulatory closure.

Image source: Internet

2. All existing individual businesses and companies must complete tax registration

Recently, many individual business owners have received text messages reminding them to complete tax declarations. This stems from the tax policy adjustment in 2026. Previously, individual industrial and commercial households and company licenses that did not open tax registration will be automatically opened by the system. If the tax is not reported on time for three consecutive months, the enterprise will be listed as an "abnormal household", resulting in the suspension of invoice function and impact on credit. Some cross-border individual business owners used to only apply for business licenses but not tax registration. This group needs to pay attention to information and declare in time.

3. Big data has penetrated, and the number of false invoice cases increased by 32%in 2025

The meeting of the presidents of the national higher people's courts revealed that the number of criminal first-instance cases accepted by national courts continued to decline in 2025, but the number of cases of crimes that undermine the order of the socialist market economy increased by 2.2%, among which the number of false invoice cases increased by 32%. The meeting proposed to strengthen the judicial path research on rectifying "involution" competition and strengthen judicial anti-monopoly and anti-unfair competition. The industry reminds that if you need to supplement invoices, you can supplement them with suppliers. Do not risk issuing false invoices to avoid operational risks.

1. Can cross-border sellers use multiple modes such as 0110 and 9810for customs declaration at the same time, and meet the compliance requirements at the tax level? Is this statement correct? After consulting experts, the regulatory authorities do not stipulate that enterprises can only use one customs declaration method. The tax department is concerned about the authenticity of the business, not the specific code used. However, it is not recommended to operate under the same entity because the financial system is prone to confusion and documents are difficult to verify. It is recommended that large stores with high unit price and high profit can set up Company A to apply for tax refund through 9810, and the money directly returns to Company A; for SKU with mass distribution, consider setting up Company B to apply for tax refund through 0110, and connect with Hong Kong companies for revenue collection. Ensure that each mode follows its own independent and complex regulatory requirements. 2. It is compliant to use a third-party DXP IDfor declaration instead of one's own DXP IDfor 9810customs declaration. Is it true? This statement is not entirely correct. After consultation, DXP ID is the legal digital identity of enterprises in the customs data exchange platform. All entities participating in 9610/9710/9810/1210 declaration must have a DXP ID. Enterprises can apply for their own ID, build their own systems to operate and push orders, or entrust third parties to operate on their behalf, but there will be inconsistencies between the declaration subject and the tax refund subject during tax refund. If the seller does not have a DXP ID, it is similar to customs declaration for others. Therefore, even if it is pushed by a third party, it is recommended to use the seller's own ID, and at the same time use excellent ERP or declaration system services from third parties to assist you in managing data. Moreover, comprehensive test areas usually provide systems for enterprises to push orders, most of which are free, and buyers can use them directly.

1. Can supplementary invoices be traced for deduction?? Answer:VAT follows the principle of "current period deduction", and the input tax amount of supplementary invoices can only be deducted in the current period of invoice issuance. For corporate income tax, supplementary invoices can be traced back to the year of expenditure occurrence for pre-tax deduction, with a maximum trace-back period of 5 years, and the transaction must be verified as true. 2. Is it feasible for e-commerce enterprises to rotate entities to maintain small scale?? Answer:Not feasible. Tax departments strictly monitor through big data, and the identities of the entities before and after the change must be reported, and the unique identification code of the store cannot be changed. Mainstream platforms such as Amazon have also strengthened the review of entity changes and strictly investigated the behavior of frequently changing entities in a short period of time. 3. Is it better to do export tax refund or tax exemption now?? Answer:There is no absolute answer. The core depends on the situation of obtaining invoices and the scale of business. For small scale, suppliers can only issue ordinary invoices or it is difficult to issue invoices, tax exemption is the only choice; when special invoices can be obtained and costs are controllable, tax refund is more formal and has additional income (for example, if the invoice tax rate is 8% and the tax refund rate is 13%); small and medium sellers give priority to tax exemption to avoid the trouble of obtaining invoices; for those who can obtain special invoices compliantly, tax refund is the best solution. 4. Will sellers' personal overseas bank cards be required to pay additional taxes?? Answer:Under the CRS rules, all overseas income of sellers such as personal-to-person transfer of goods payments, withdrawal from overseas platforms, dividends, and rent must be declared and taxed according to law. If personal accounts are used to receive store income, it will be regarded as enterprise income, and then VAT and corporate income tax will be checked. 5. Can freight forwarders issue customs declaration fees on behalf of others for export tax refund?? Answer:Yes. But it should be noted that customs declaration fees belong to domestic agency services, not international transportation services. Freight forwarders should issue special invoices with a tax rate of 6%, which can be used for input tax deduction. For the advance payment of inspection fees, amendment fees, etc., freight forwarders can provide original payment vouchers (to avoid the risk of false invoices), and such invoices do not affect export tax refund. 6. What to do if the invoice product name is different from that on the customs declaration form?? Answer:If it is only a difference in expression such as synonyms and typos, you can skip the doubt in the tax refund declaration system, submit the "Product Consistency Explanation" and supporting materials such as contracts and packing lists; if it is an error in declaration entry, directly modify the detailed data in the tax refund system; if it is a substantial difference, if the invoice is wrong, return it for cancellation or red cancellation and reissue, if the customs declaration form is wrong, contact the customs broker to apply for amendment, and handle tax refund after correction. PART.4 1. More urgent than the year-end inspection is the corporate income tax settlement and payment before the end of Mayeach year.According to tax laws, during the settlement, the tax system will comprehensively compare the enterprise's annual data, including VAT declaration, platform flow, bank receipts, and financial statements. For those enterprises that have been lacking input invoices for a long time, have not carried out export customs declarations, or directly transfer profits to personal accounts through third-party payment tools to pay salaries and supplier payments, the compliance of their business models will face severe challenges. These operations are easily identified by the system as concealing income, thereby incurring significant tax risks. 2. Collaborative supervision has become the mainstream trend of tax compliance for cross-border e-commerce.Under the background of increasingly strict big data supervision and the full implementation of the "Golden Tax Phase IV", the data of industry and commerce, customs, banks, tax and other parties are closely linked, and multi-party collaborative supervision has become the mainstream. Against this background, small and medium-sized enterprises must deeply grasp the latest tax rules, improve their financial and tax systems, cultivate professional talents, respond to complex and changeable compliance requirements, and avoid unnecessary tax risks.

Cross-border e-commerce Hugo.com

Cross-border e-commerce Hugo.com