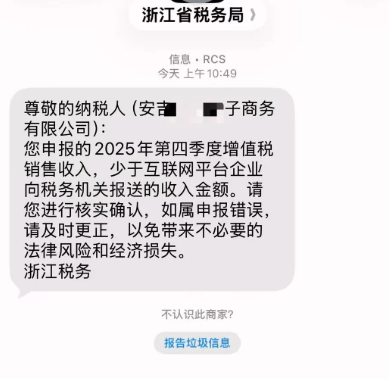

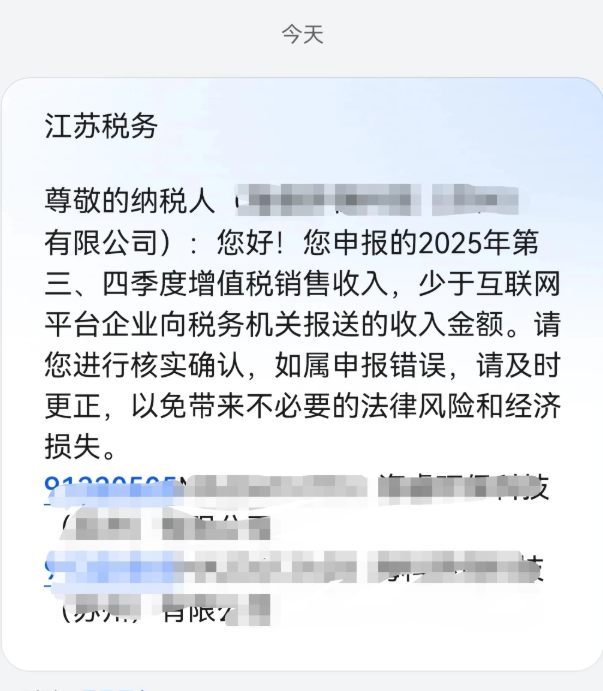

"The VAT sales revenue you declared for the fourth quarter of 2025 is less than the income amount reported by the internet platform company to the tax authorities."Early in the morning on February 5th, Amazon sellers in multiple provinces and cities such as Zhejiang, Anhui, Guangdong, and Jiangsu almost simultaneously received this warning text message.

After a brief period of calm, the cross-border communication groups of the sellers began to become restless. "Did everyone receive the text message?" "What does this signal mean?"

01

Did you receive a tax text message reminder?

The specific content of the text message is: Dear taxpayer, the VAT sales revenue you declared for the fourth quarter of 2025 is less than the income amount reported by the internet platform company to the tax authorities. Please verify and confirm. If it is an error in the declaration, please correct it in time to avoid unnecessary legal risks and economic losses.

Just a few lines of text, but many sellers' fingers began to tremble unconsciously:

"I received this text message, but I don't know how to deal with it as a small seller."

"I also received it. I don't know what to do. I have been declaring zero all along."

Some sellers have already declared according to the income in the payment report, but they also received the text message reminder:

"I received it... I clearly reported according to the platform data."

"I declared according to the income. I received it."

"I reported truthfully. I also received it today. I think it's phishing."

"My sales volume is more than 800,000 and I paid more than 8,000 VAT. I also received it. I don't know what to do."

Some sellers opened a case to ask Amazon customer service, and the reply was: Wait for Amazon's tax team to send an email to notify the synchronization of the submitted data. Currently, the specific time of this submission cannot be determined.

Some tax experts pointed out that this warning text message is usually automatically triggered based on a risk identification model, mainly targeting taxpayers with high-risk indicators such as abnormal declaration data and obvious mismatches between sales volume and tax payable. The sending time is selected after the end of the fourth-quarter declaration period, which has obvious compliance reminders and risk warnings.

Some sellers sighed: "Although I know that the text message is generally triggered by the tax system, if I ignore it, I feel uneasy. If I pay attention to it, I feel at a loss."

02

Some Sellers Are at a Loss

Some sellers are anxiously looking for answers everywhere, but they still can't be sure which standard to declare according to? Is it according to the "net income" (income after deducting refunds) in the platform summary report? Or according to the sales amount corresponding to the order shipping date (Credits Subtotal)? Or according to the actual amount of payment received?

Some sellers said: "According to the income, my US income is 3% less than the tax bureau data. I heard that the difference in Europe is relatively large. Now the policy is very clear. Invoicing + customs declaration, still hoping for separate policies such as tax bureau's payment collection, it's a pipe dream."

Some sellers believe: "Declare according to the income first, or underreport a little. If the difference is large, the tax will find it, and then correct it. The data given by the tax in the third quarter was a little more than the income, but the difference was not very large."

Some sellers think: "I will report according to the payment received first, because the current annual income is not clear how to calculate, whether advertising can only be calculated at 15%, and the part exceeding and the actual profit greater than 300 is equivalent to working for nothing last year. The customs declaration amount is different from the payment reported, so I can only adjust as I go."

On January 31, the Shenzhen Municipal Bureau of Commerce issued the "Notice on the Optimization and Launch of the 'Tax-Free Without Invoice' Registration Module of Shenzhen Cross-border E-commerce Online Comprehensive Service Platform", and the optimized "Tax-Free Without Invoice" registration module was officially launched on February 1, 2026.

According to the official notice, this policy is only for cross-border e-commerce retail export ("9610") enterprises.

This policy applies to the cross-border e-commerce retail export mode with the customs supervision code "9610" (including customs declaration summary and non-summary list). Specifically applicable to domestic shippers, production and sales units, and actual sellers noted in the header of the customs declaration form of the 9610 export list/customs declaration form.

The policy sets clear conditional restrictions: It only supports Shenzhen enterprises that declare through the "Shenzhen Cross-border E-commerce Online Comprehensive Service Platform Declaration and Customs Clearance List" or "Shenzhen Single Window Declaration and Customs Clearance Form". Enterprises can handle "Tax-Free Without Invoice" registration through the comprehensive service platform (https://www.szceb.cn/), realizing full-process electronic operation. Enterprises must make an appointment for registration at least 2 natural days in advance after the export goods "customs clearance", and the system will open the data confirmation function on the third day (T+2) after the appointment.

Subsequently, with the success of the Shenzhen pilot, this policy is expected to be extended to 165 "Cross-border E-commerce Comprehensive Pilot Zones" nationwide in 2026.

In addition, more sellers are currently waiting for Amazon's relevant policies to be implemented.

Anyway, the era of wild growth for cross-border sellers has quietly come to an end.Tax compliance is the lifeline of cross-border operations. Every seller must fulfill the tax declaration obligations according to the law and ensure the authenticity, accuracy, and consistency of sales data, capital flow, and tax declarations. When necessary, consult a financial and tax expert or professional service organization with cross-border experience in time to obtain authoritative guidance and achieve stable and long-term operation.

The information related to this article is for reference only and is not used as the basis for investment decisions

Seller's Home

Seller's Home