"Youke Shu" is about to become history, and the new name "Xingyun Technology" is about to step onto the A-share stage.

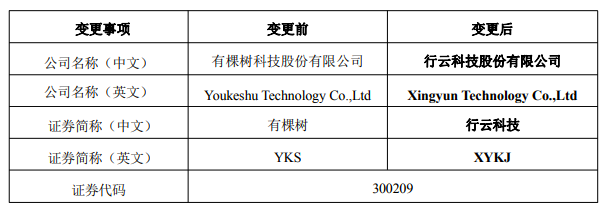

According to the company's announcement, Youke Shu Technology Co., Ltd. has completed the board of directors' review and plans to change the company's name to Xingyun Technology Co., Ltd.The stock abbreviation will also be changed from "Youke Shu" to "Xingyun Technology", and the stock code 300209 remains unchanged.

A company once hailed as one of the "Four Young Masters of South China City" in cross-border e-commerce may be on the verge of a rebirth after suffering four years of losses exceeding 4 billion yuan, plunging performance, and internal equity struggles.

01

Change of Control,

Wang Wei Team Takes Full Control

Behind the renaming of Youke Shu is a complete switch in actual control.

According to the company's announcement, the main purpose is to "more comprehensively reflect the company's industrial layout and operating conditions," and to "highlight the corporate brand of Shenzhen Tianxingyun Supply Chain Co., Ltd., the core industrial investor."

At the end of 2024, the Changsha Intermediate People's Court ruled that the company's "Reorganization Plan" was fully implemented, terminating the reorganization procedure. Shenzhen Tianxingyun Supply Chain Co., Ltd., as the core industrial investor, intervened, and its actual controller, Wang Wei, ultimately gained dominance over the company through a series of capital operations and governance arrangements.

As of the announcement date, Wang Wei directly holds 9.89% of the shares, and together with his concerted parties, they hold a total of 18%, becoming the core of the company's actual control.The original actual controller and founder, Xiao Siqing's shareholding has been diluted to 3.28%, and he has completely withdrawn from management after the board of directors' election in October 2025.

On October 10, 2025, the new board of directors nominated by Wang Wei completed the early election, and the new executive team took full control of the company's operations. According to the announcement, as of December 31, 2025, the company has completed the control of the seals and business licenses of 26 subsidiaries and has paid 100 million yuan in funds for business expansion, initially completing the governance structure and asset integration.

As of the date of the announcement, the company still has some unfinished business handovers of subsidiaries, involving financial statement data amounts of total assets of 64.7076 million yuan, net assets of -10.5955 million yuan, and operating income of 601,200 yuan, accounting for 5.52%, -1.11%, and 1.17% of the consolidated statements in the first three quarters of 2025, respectively.

02

Under Pressure,

The Road to Transformation is Full of Challenges

Although the control dispute has come to an end, the company's operational fundamentals are still not optimistic.

Youke Shu was once a leader in China's cross-border e-commerce industry. In the "Wild West era," the company rapidly rose with its distribution model, and its revenue once exceeded 5 billion yuan in 2020. However, the good times did not last long. The large-scale Amazon store closure incident in 2021 dealt a heavy blow to the company, with a loss of nearly 2.7 billion yuan that year. From 2020 to 2023, the total loss in just four years amounted to 4.4 billion yuan.

This time,the third-quarter report of 2025 disclosed simultaneously with the renaming announcement also showed a not-so-good report card:

Total revenue plummeted 82% year-on-year: revenue in the first three quarters was 58.9567 million yuan, a decrease of 82.02% year-on-year, and revenue in the third quarter alone was only 16.3833 million yuan, a decrease of 83.59% year-on-year, indicating that the business scale has shrunk to the ten-million level.

Net profit loss narrowed but worsened in the single quarter: the net loss attributable to the parent company in the first three quarters was 13.8528 million yuan, a 54.68% reduction year-on-year, mainly due to a slight profit in the first half of the year; but the loss in the third quarter alone expanded to -15.7298 million yuan, a decrease of 5169.86% year-on-year, reflecting that operating pressure concentrated in Q3.

It is worth noting that in the first half of 2025, the company still achieved a profit of 1.877 million yuan, successfully turning losses around, but the huge loss in the third quarter not only devoured the previous results but may also drag down the annual performance to turn negative again.

In addition, the company is also involved in an international logistics service contract arbitration case with an amount of nearly 100 million yuan (96.4079 million yuan), further exacerbating cash flow and compliance risks.

Despite the weak fundamentals, the capital market has shown optimism towards the renaming and reorganization. As of the close on January 26, 2026, the company's stock price was 7.23 yuan/share, up 15.50% on the day, up about 56% in the past year, with a total market value of about 6.7 billion yuan.Analysts point out that investors are betting on the resource integration capabilities and long-term transformation potential of industrial investors.

Tianxingyun Group, as a global B2B service platform for goods, serves nearly 3,000 consumer brands, covering 150,000 SKUs, and has 170 overseas warehouses with a total area of over 1.3 million square meters.

The market generally expects that with its mature digital supply chain system and channel resources, Xingyun Technology can break away from the old model of "multi-platform distribution and extensive expansion" and turn to a new path of cross-border e-commerce that is refined, branded, and service-oriented.

From "Tianze Information" to "Youke Shu," and now to the upcoming "Xingyun Technology," this listed company has changed its name three times in ten years.

The story of Youke Shu began in 2000, initially existing under the name of Tianze Information Industry Co., Ltd. In its early days, the company mainly operated IoT and industrial internet software and hardware services until it officially entered the cross-border e-commerce field in 2017 by acquiring 99.9991% of the equity of Shenzhen Youke Shu Technology Co., Ltd.

On November 11, 2022, the company's full name was changed from "Tianze Information Industry Co., Ltd." to "Youke Shu Technology Co., Ltd.," and the company's stock abbreviation was changed from "Tianze Information" to "Youke Shu."

On February 11, 2026, the company's full name was changed from "Youke Shu Technology Co., Ltd." to "Xingyun Technology Co., Ltd.," and the company's stock abbreviation was changed from "Youke Shu" to "Xingyun Technology," with the stock code remaining unchanged at "300209."

The once resounding name "Youke Shu" will gradually fade from people's sight. The transformation journey of Xingyun Technology has just begun.

The information in this article is for reference only and should not be used as the basis for investment decisions

Seller's Home

Seller's Home