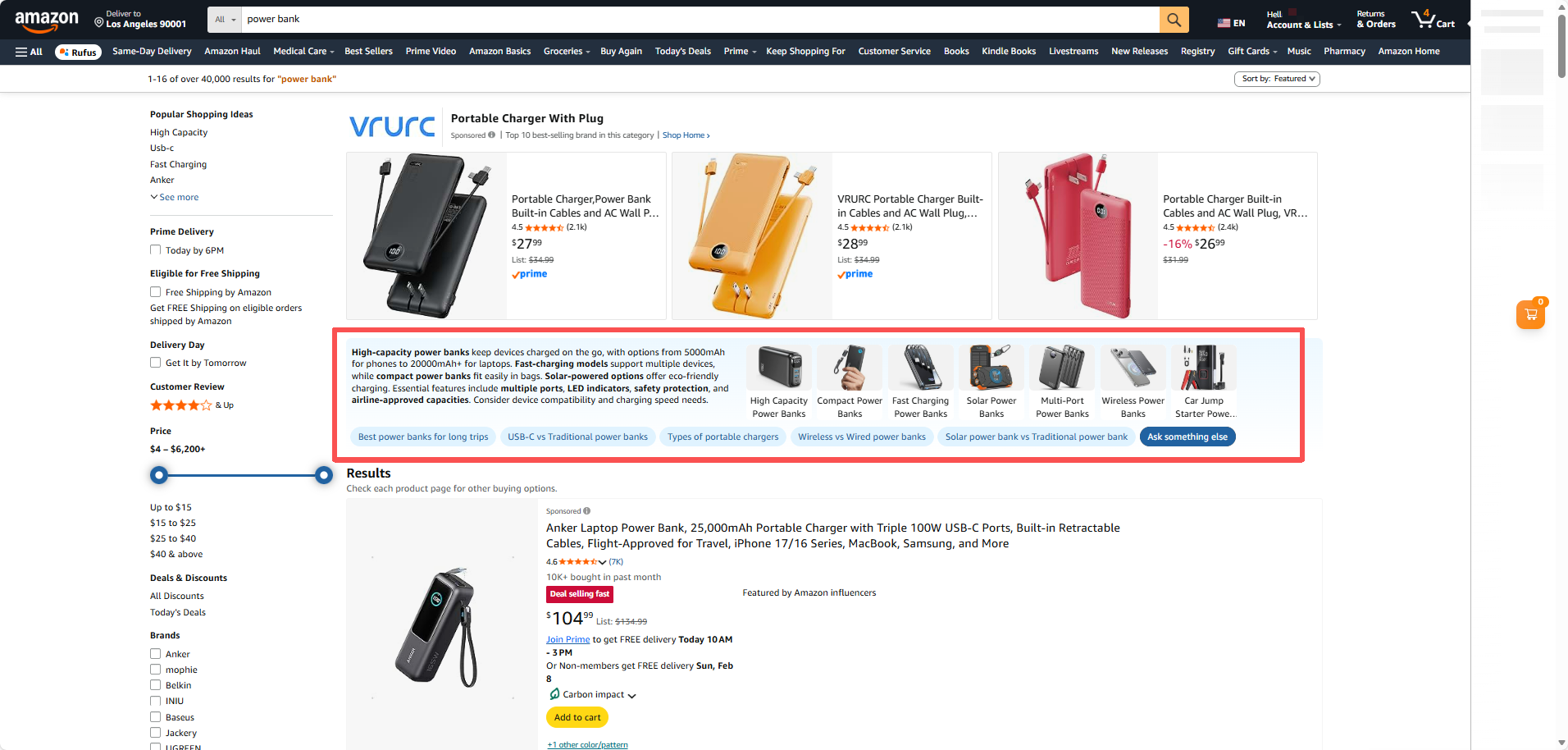

If sellers have recently paid close attention to the Amazon front-end search results page, they may have faintly noticed something: the search results page seems to have changed quite a bit.

In the past, when buyers searched for a term, such as "power bank" or "toys", the logic of the page was very simple—who ranked higher, who was seen first, and it was all about ranking through a combination of ads and organic listings.

But now it's different. At the top of the search results page for several major terms, an AI-driven "Shopping Decision Guide" area is emerging, taking over the "first impression" of user shopping.

Image source: Amazon

The homepage of the search results page has been "intercepted" by Rufus.

When buyers now search for major terms like "power bank", they will find that before the product list, what they see first is:

-

A shopping guide copy automatically generated by Rufus AI, briefly describing the category characteristics.

-

Below that are 6-9 clickable images and keyword sub-category entry points.

-

A prominent Rufus dialogue question entry point.

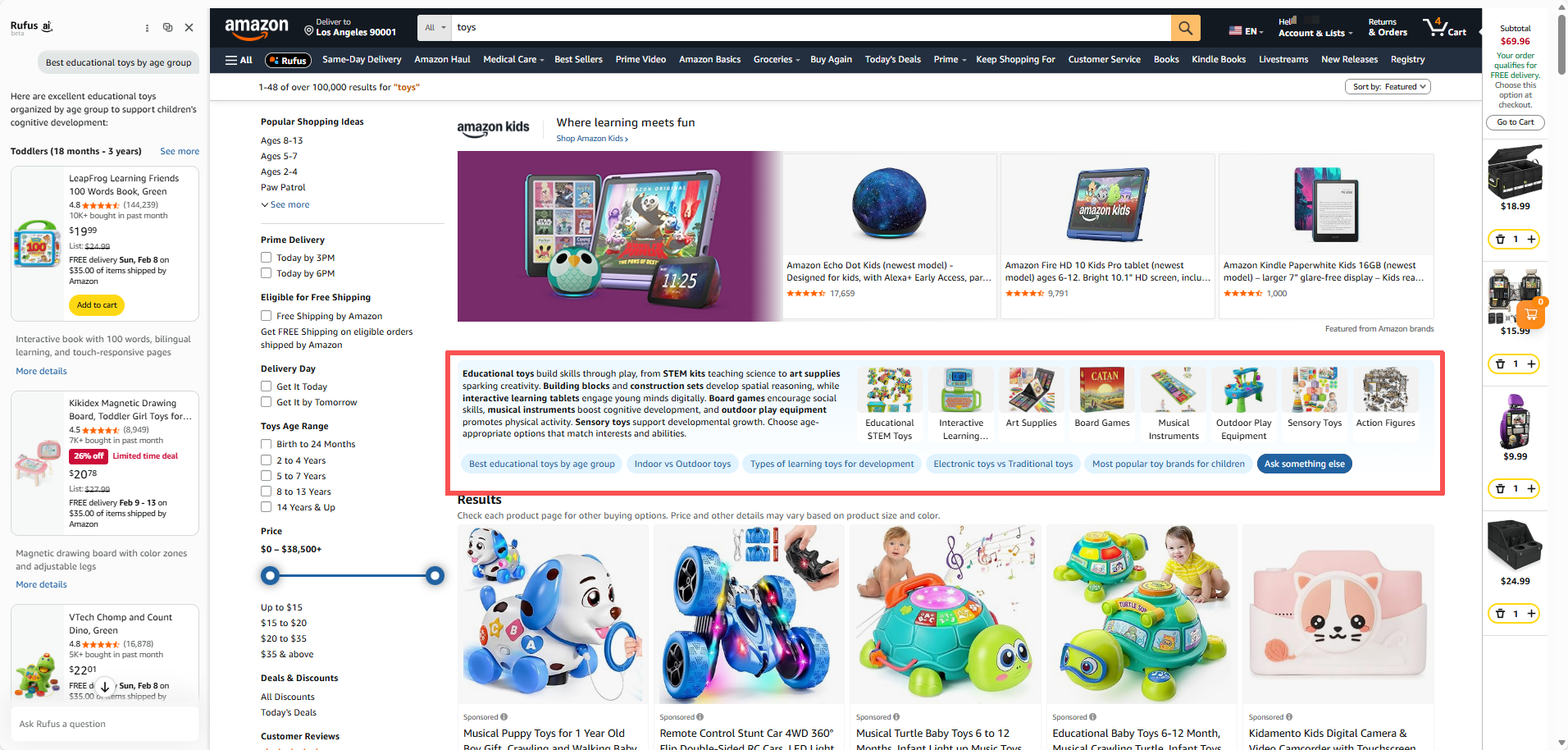

Image source: Amazon

For example, when searching for "toys", you will see options like "Brain Teasers for Different Ages", "Educational Toys", and "Interactive Learning". When searching for "power bank", categories such as "High Capacity", "Compact and Portable", and "With USB-C Fast Charging" will be presented.

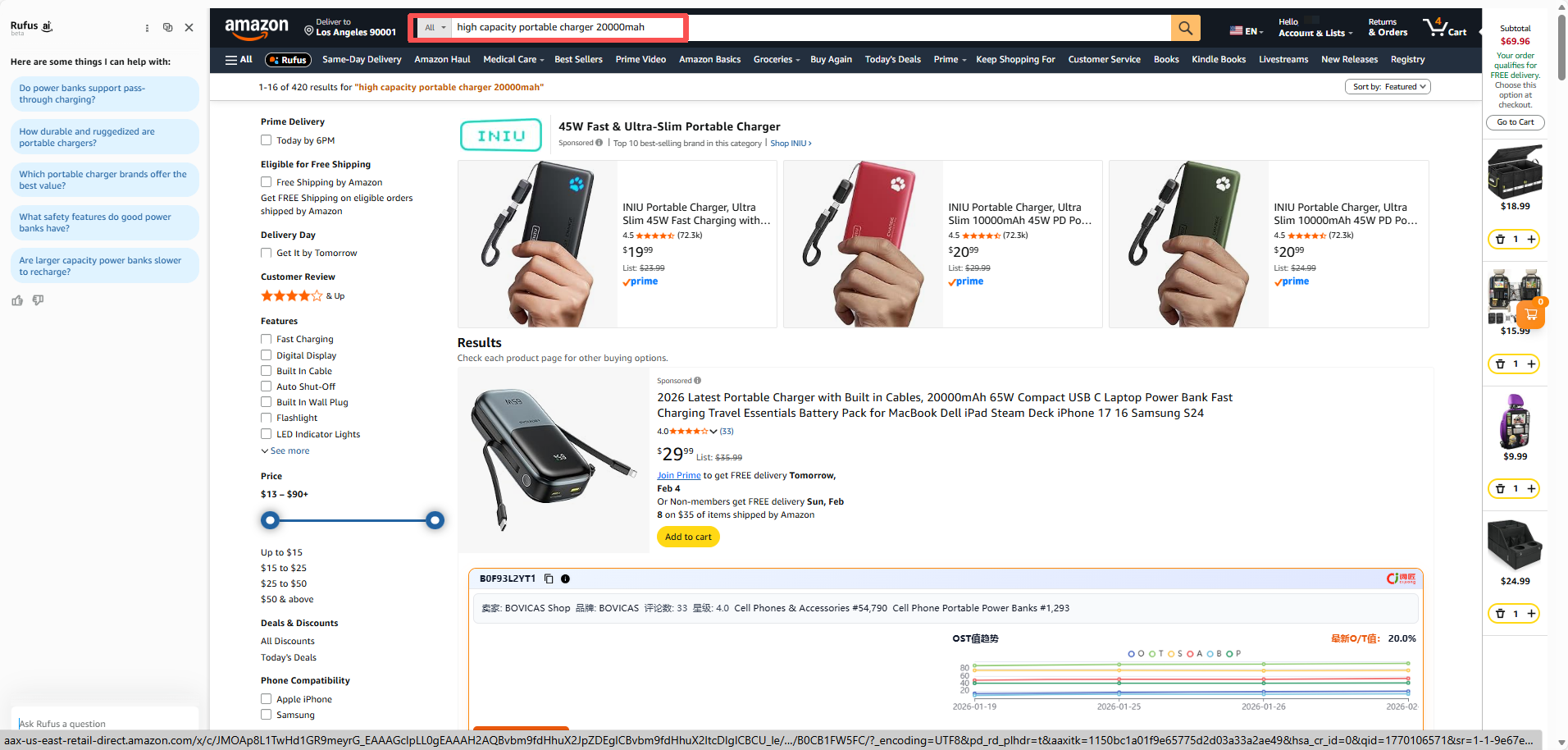

If a user clicks on a sub-category option such as "high capacity portable charger 20000mah", the page will not directly display products but will jump to the results page for that sub-keyword. If they click on the Rufus question below, the Rufus dialogue bar will automatically appear on the side, guiding further filtering.

Image source: Amazon

This step occurs before users actually start "browsing products". In other words, before it's your turn to compete with main images, prices, and star ratings, Rufus has already redistributed and redivided the traffic in advance.

Behind this is a deep update of Amazon's search logic: the system believes that all products under a major term may not be of the same level or purpose.

So, in Rufus's logic, this "Shopping Decision Guide" directly tells users: "The term you searched for is too broad. Why not choose a specific direction first, and I'll show you?"

Rufus's logic doesn't care if you're a major term, an old link, how beautiful your historical sales are, or even how aggressively you burn ads. It cares about a more "AI-oriented" question: in a specific demand scenario, do you look like the "correct answer"?

So there's a very interesting phenomenon: some sellers with average rankings for major terms are more likely to be pulled out by Rufus in sub-terms; some sellers who steadily rank in the top for major terms have their traffic continuously diluted after Rufus diversion.

If you think of Rufus as a "shopping guide", what it does is very straightforward:

-

Help users narrow down their choices.

-

Reduce ineffective browsing.

-

Quickly find the products that are "more like the answer to the demand".

What does this mean? The system is using AI to ask sellers a question: Who is your product for?

This change shifts the competition dimension from simple "keyword ranking" to a more fundamental level: your understanding of the product and user needs.

Rufus's recommendation logic inevitably relies heavily on Amazon's mining of massive data (search terms, clicks, purchases, Q&A, reviews). It tries to understand whether "powerbank" is for "long-distance travel backup", "iPhone fast charging", or "compact and portable".

Therefore, for sellers, the operating logic must also be upgraded:

-

Deepen sub-keyword weight: In addition to core major terms, it is necessary to systematically optimize Listing content and conversion data under sub-scenario keywords most relevant to your product to establish sub-keyword weight.

-

Reconstruct Listing content: The title, five-point description, images, videos, and A+ pages of the Listing need to more accurately correspond to these sub-scenes and specific needs, so that both AI and users can understand at a glance: what problem are you answering?

-

Pay attention to COSMO and Rufus: Rufus's decision-making area is placed in such a prominent position, which means that the "Q&A" section and scene keywords in user comments have become unprecedentedly important. Predicting in advance the questions users may ask in sub-scenes and providing clear, focused answers will become a new competitive point.

Amazon is quietly changing the first decision-making logic of search. From the past priority of ranking to now: "Which direction should you look for first?"

Under this logic, major terms are no longer the moat for sellers, and sub-demands are the real entrance to determine whether your link is seen.

For sellers, the real competition is no longer in "ranking skills", but whether the product is understood by the system.

The value of the Listing is no longer just piling up keywords, but clearly answering three questions: Who are you for? What scenarios are you used in

Cross-border E-commerce Excellent Craftsman School

Cross-border E-commerce Excellent Craftsman School