A sudden winter storm swept across two-thirds of the United States, catching Amazon sellers off guard as they watched orders plummet and some shipments delayed.

Starting from January 23rd, an extremely large-scale storm swept across more than 22 states in the United States, bringing widespread snowfall and extreme low temperatures. Data as of the afternoon of January 25th showed that over one million households and businesses across the country had lost power, mainly concentrated in the severely affected southern and midwestern regions.

The National Weather Service predicts that this winter storm is expected to continue until the evening of the 26th, followed by extremely cold weather. Allison Santorelli, a meteorologist with the National Weather Service, told the media that after the storm, temperatures will drop sharply, and the melting speed of snow and ice layers will be extremely slow, which will hinder post-disaster reconstruction efforts.

01

USPS Logistics Alert and Sales Decline

Affected by extreme weather, Amazon sellers in the US have seen a cliff-like drop in order volume.

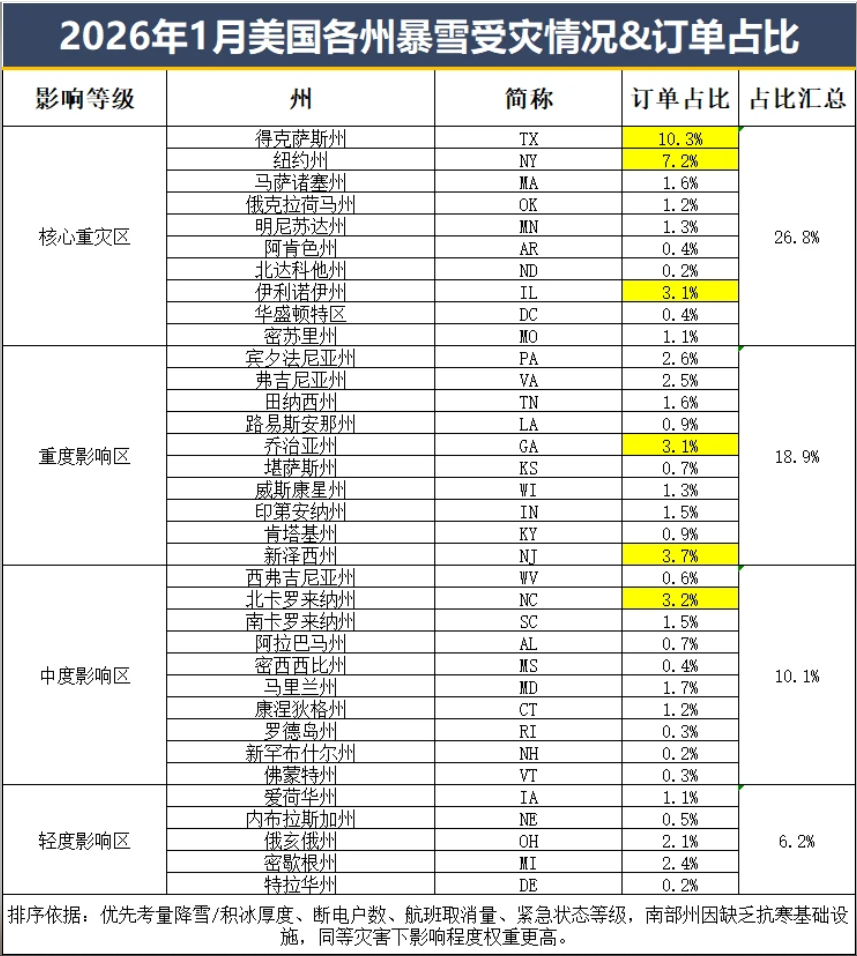

A seller listed the impact of the US snow disaster on Amazon orders in a table, saying, "I checked the disaster situation in various states in the US in January and organized the order data of my store for nearly half a year. I found that the order proportion in severely affected states actually reached 45.6%. No wonder sales have dropped so much recently. Compared with this time last year, sales would normally increase significantly, but this year it's really much worse."

Screenshot from Xiaohongshu

And the sellers experiencing sales declines are far from just one. Sellers lament:

"My outdoor category has dropped to half in the past two days, and it's also 30% lower than last year."

"Sales have been dropping these days."

"It's down 3/4 from yesterday."

"Advertising costs more than yesterday! But the order volume just doesn't come out!"

"It plummeted a few days ago, and today is just a continuation."

Extreme weather has caused a significant change in consumers' shopping priorities, with necessities becoming the main purchase targets and demand for non-necessities dropping sharply. Moreover, this situation also overlaps with the off-season and tax season, further squeezing consumer demand.

Some sellers said, "My sales are so sluggish today, but advertising is still cool. And I found that the delivery time has been delayed, and there are also more orders that have not been completed for delivery settlement."

Cross-border veteran Mike said that affected by this winter storm,more than 70 FBA warehouses across the United States have been forced to close temporarily, accounting for about one-third of the total number of FBA warehouses in the United States. In addition to the temporarily closed warehouses, more Amazon FBA warehouses have experienced varying degrees of delays in rocket storage, shelving, and outbound due to blizzards, power outages, and road closures.

The United States Postal Service (USPS) also had to issue a red alert, warning of nationwide delivery delays. USPS said that severe weather may affect the processing, transportation, and delivery of mail and parcels in the northern plains, the Great Lakes region, the Ohio River Valley, and the Northeast.

02

Consumers Turn to Lower-Priced Goods

Worryingly, in addition to natural disasters, Amazon sellers also face continuous policy pressure. Amazon CEO Andy Jassy recently said that the impact of US tariff policy is gradually reflected in commodity prices. Of course, price increases are affected by multiple factors. In addition to tariffs, recent raw materials, exchange rates, and other factors also have a significant impact on prices.

Many industry insiders believe that considering the impact of exchange rates and raw materials on profits, price increases may be the only option, and this price increase also has a certain impact on sales declines.

It is reported that Amazon and many of its third-party merchants have pre-purchased inventory in an attempt to complete transactions before tariffs take effect, thereby keeping prices low, but most of the inventory was sold out last fall.

"So you will see some tariffs beginning to penetrate into the prices of some goods. Some sellers decide to pass these higher costs on to consumers and sell at higher prices; some sellers decide to bear these costs themselves to stimulate demand; and some sellers take a practice between the two," Jassy said. "This impact is becoming more and more obvious."

Amazon CEO Jassy said last Tuesday that Amazon is striving to "reduce consumer prices as much as possible," but in some cases, price increases may be inevitable. "You know, the operating margin of the retail industry is usually only a single digit, so to a certain extent, if costs rise by 10%, there is not much room to absorb this part of the cost," Jassy said.

But Jassy also said that consumers are still "quite resilient" and are still consuming under the influence of tariffs. However, he pointed out that tariffs do affect the purchasing habits of some consumers. Amazon has observed thatsome people begin to turn to buy lower-priced goods and look for discounted goods, while others postpone the purchase of higher-priced non-necessities.

At present, some sellers are actively looking for lower-priced goods to cope with the increased price sensitivity of consumers. This is indeed a strategy to adapt to market changes in the short term. However,in the eyes of industry experts, low price should not be the only competitive advantage.Chinese cross-border enterprises need to reflect on their business models and seek differentiated development directions to achieve a win-win result.

A single low-price model is extremely vulnerable in the face of external shocks. For example, the large-scale logistics delays and warehouse closures caused by this winter storm directly increased the seller's performance costs and inventory risks. In this case, the already meager profit margin of low-priced goods may be completely eroded, or even lead to losses.

From the consumer side, the market is stratifying. Although some consumers are extremely price-sensitive, there are also a large number of consumers who assign higher value to non-price factors such as delivery reliability, product quality stability, and customer service response speed.

In addition, sellers need to enhance added value through product innovation, quality control, or precise customer targeting, allowing customers to pay for "worthiness," not just "cheapness."

Low price can be a stepping stone to enter the market, but it cannot be the only competitive advantage.

The information related to this article is for reference only and is not used as the basis for investment decisions

Seller's Home

Seller's Home