With less than a month left in 2024, Amazon's multiple adjustments to its algorithms and policies have had a profound impact on sellers' operational strategies. To help everyone sort out these changes, we have compiled some important updates for 2024, covering four major aspects: algorithm changes, platform changes, policy changes, and store listing requirements changes, hoping to provide sellers with references for optimizing operations.

01 Amazon Algorithm Changes

1. Launch of the new AI algorithm COSMO

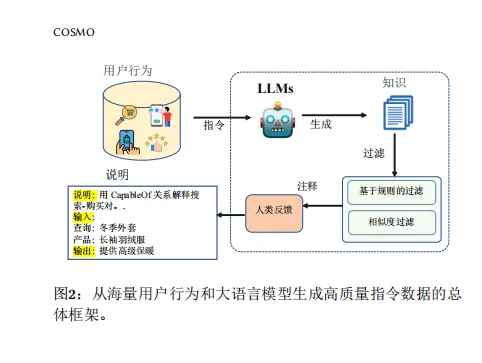

COSMO first appeared in a paper on the amazon.science website in March this year, mentioning that the COSMO algorithm mines common sense knowledge from user behavior data, constructs a large-scale knowledge graph, and improves the accuracy of search results, which is quite different from the traditional A9 algorithm.

Currently, we speculate that the COSMO algorithm has been fully deployed across all categories on Amazon, and the recent large-scale loss of natural positions for sellers is very likely due to this reason.

Source: Amazon

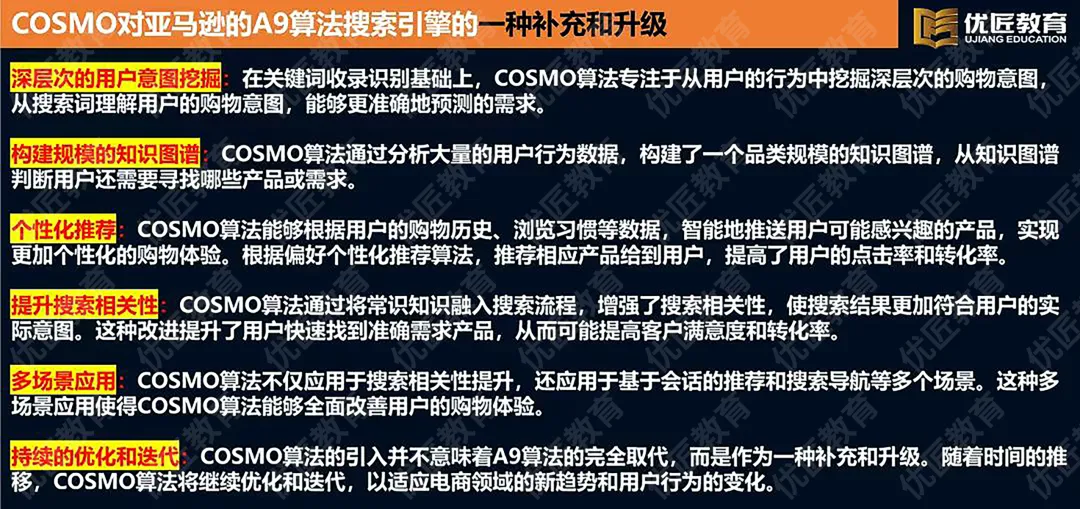

As an advanced large-scale data language model algorithm, COSMO, compared to A9, pays more attention to the actual needs and behaviors of users, as well as having a more accurate understanding of user profiles, smarter recommendation algorithms, and a high-quality knowledge graph covering all categories. Regarding the five differences between COSMO and A9, you can refer to our previous article "The 5 Major Differences Between Amazon's COSMO Algorithm and A9 Algorithm".

Source: Dong's Course

In terms of operational methods, unlike A9, which focuses on matching user needs with keywords and product attributes, the COSMO algorithm is centered around user behavior, focusing on users' search intentions and usage scenarios. The specific difference is that when a buyer searches for "portable Bluetooth speakers", COSMO will first meet the user's search needs like A9, displaying related products containing "portable Bluetooth speakers". However, COSMO will also make other judgments, such as judging the "outdoor" attribute based on the search keyword attributes and user group judgment, combined with this user's purchase history records, assuming that the buyer has recently purchased many outdoor products, the COSMO system will identify this user as an outdoor enthusiast.

Therefore, when this user searches next time, products with outdoor attributes will be prioritized in their search results page.

Therefore, in terms of operation, sellers are required to shift from the traditional product and keyword-centered operation mode to a user-centered mindset, understand their needs and preferences, use AI tools to deeply analyze the intentions and needs behind user search terms, from part-of-speech tagging to data collection, forming a comprehensive product attribute association network. When the COSMO algorithm faces this search term, it can quickly map to the relevant product attributes, achieve precise matching, make the product easier to be recognized and indexed by the COSMO algorithm, thereby making the product more likely to be prioritized in search rankings, navigation bar recommendations, Q&A recommendations, and other recommended traffic areas.

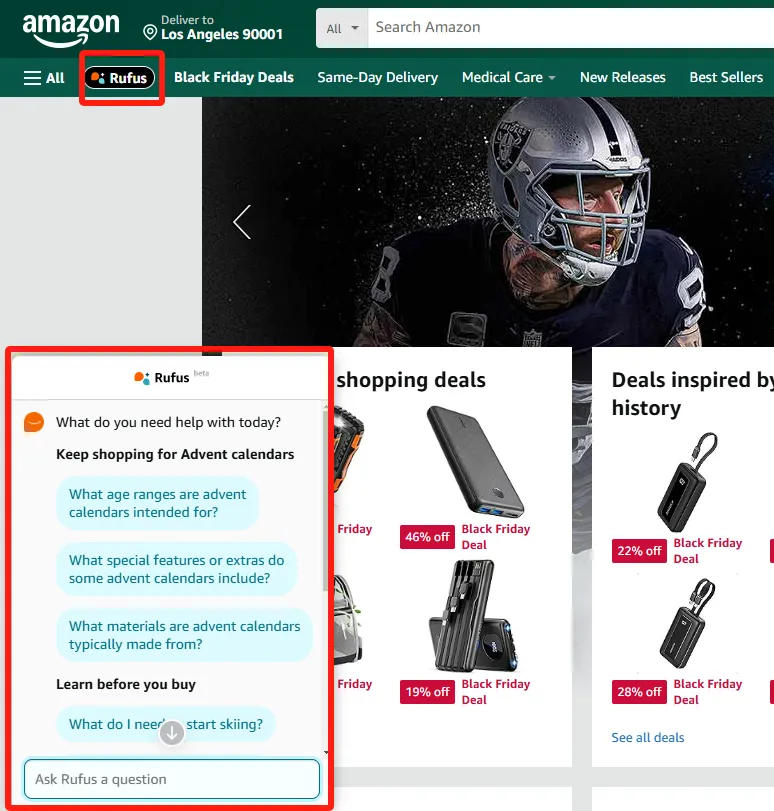

2. Launch of Shopping Assistant Rufus Function

In February this year, Amazon launched Rufus assistant to a small group of users, and by July this year, it had been fully deployed to the Amazon user interface. Rufus is a generative chatbot driven by artificial intelligence. This generative artificial intelligence is bringing buyers a dynamic and interactive shopping experience, which is very different from the traditional A9 algorithm-based search model. Rufus allows buyers to reflect their preferences, needs, and intentions, and find the products they need more naturally and intuitively.

Source: Amazon

Rufus is mainly applied in five scenarios:

Help understand product details and refer to other buyers' reviews: For example, after searching for "backpacks", you can directly find out what the material of the backpack is? You can also click on "What do the comments say".

Recommend products with the highest relevance based on crowd attributes and scene attributes: For example, ask "What is the best lawn game for a children's birthday party?"

Compare similar products: Ask questions like "What is the difference between mirrorless cameras and DSLR cameras?" to quickly compare features.

Get the latest product update information: For example, ask "What is the trend for women's jeans?" Rufus will make recommendations based on trends.

Access historical and current orders: Buyers can quickly and easily access logistics tracking and historical orders through Rufus.

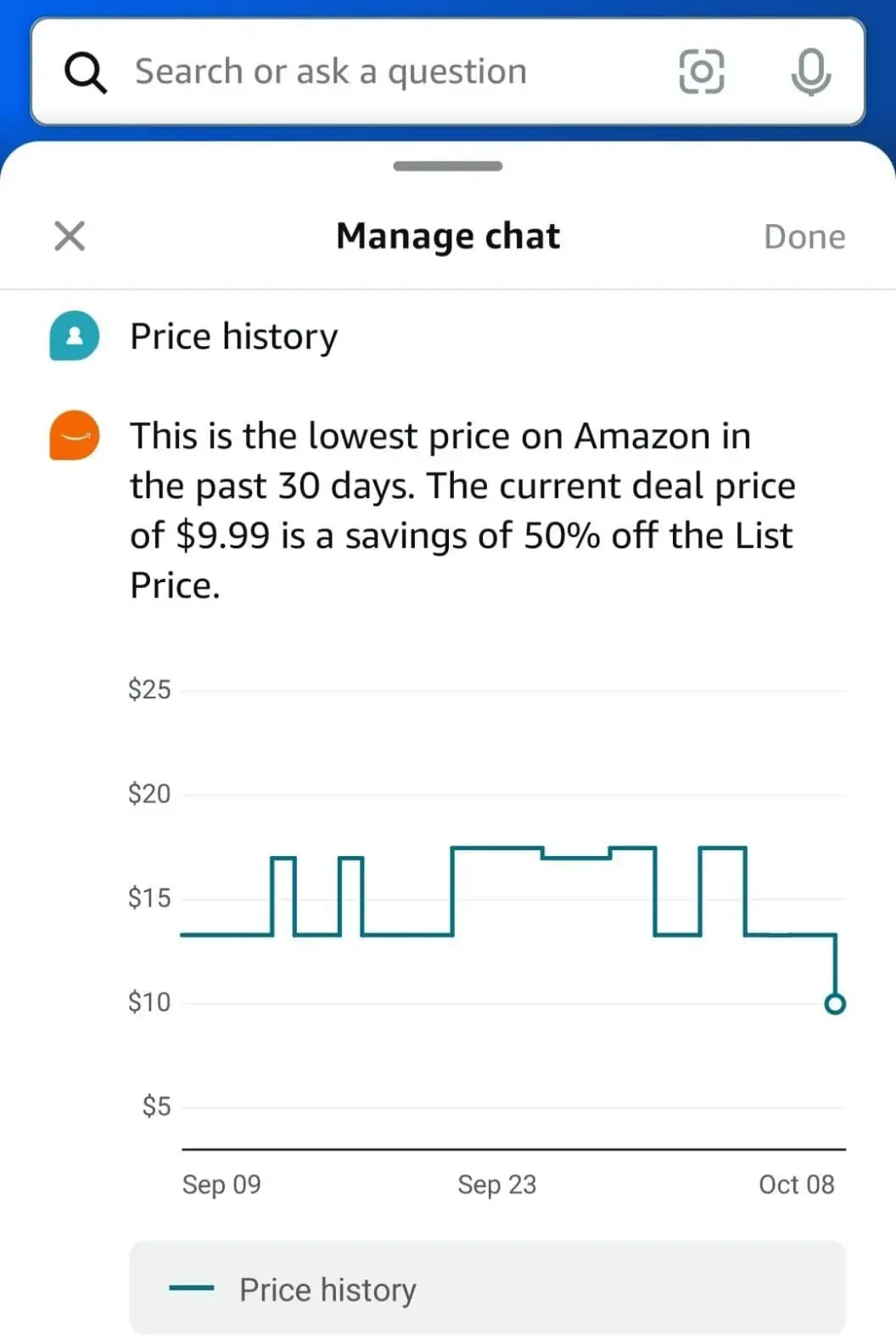

And later, Amazon will also launch the "price trend information" feature, giving buyers more price reference when purchasing.

Source: Amazon

The launch of COSMO and Rufus indicates that ranking is not just determined by simple keyword relevance, but also includes product relevance plus user behavior. It pre-judges users' needs based on their current search content combined with past search habits, purchasing habits, and user characteristics, and pushes products that meet users' needs according to the judgment. These products will be prioritized in the front of search rankings.

This fundamental difference means that sellers cannot rely solely on keyword optimization and SEO to stabilize product rankings. Search results will shift from broad visibility to targeted, intentional, and specific audience displays. This means that sellers need to deeply integrate an understanding of user needs in their operations, and require operational personnel to conduct more detailed analysis of buyer search terms and behaviors.

02 Amazon Platform Changes

1. Launch of Low-Price Stores

In June this year, Amazon held a closed-door meeting in Shenzhen for the first time, revealing that it would launch a new "Low-Price Store". After five months of preparation, Amazon's "Low-Price Store" officially went online in November (search Amazon for "haul").

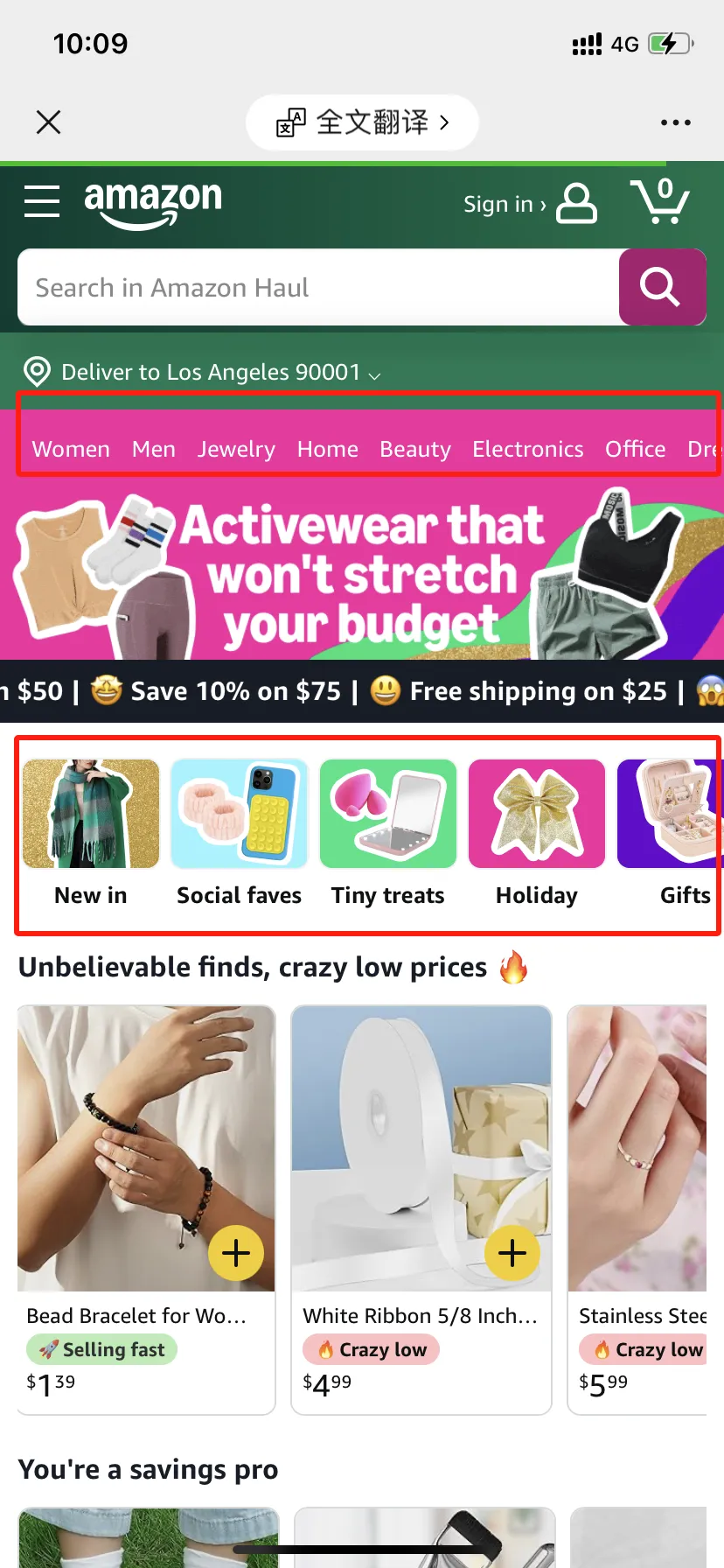

The Low-Price Store covers 15 major categories, including Women, Men, Jewelry, Home, Beauty, Electronics, Office, Dresses, Accessories, Crafts, etc., which can almost meet users' daily needs.

Source: Amazon

Although the launch of the Low-Price Store provides sellers with a new traffic entry, as a large number of sellers flock to the Low-Price Store, price competition becomes increasingly fierce, facing more serious price "involution". In 2025, if a large number of sellers choose to attack the Low-Price Store, under the impact of the Low-Price Store, products below $20 will gradually become the category with the highest price sensitivity, while products in the $20-$30 price range may become sellers' future key product selection targets.

2. Amazon Reduces Category Commissions

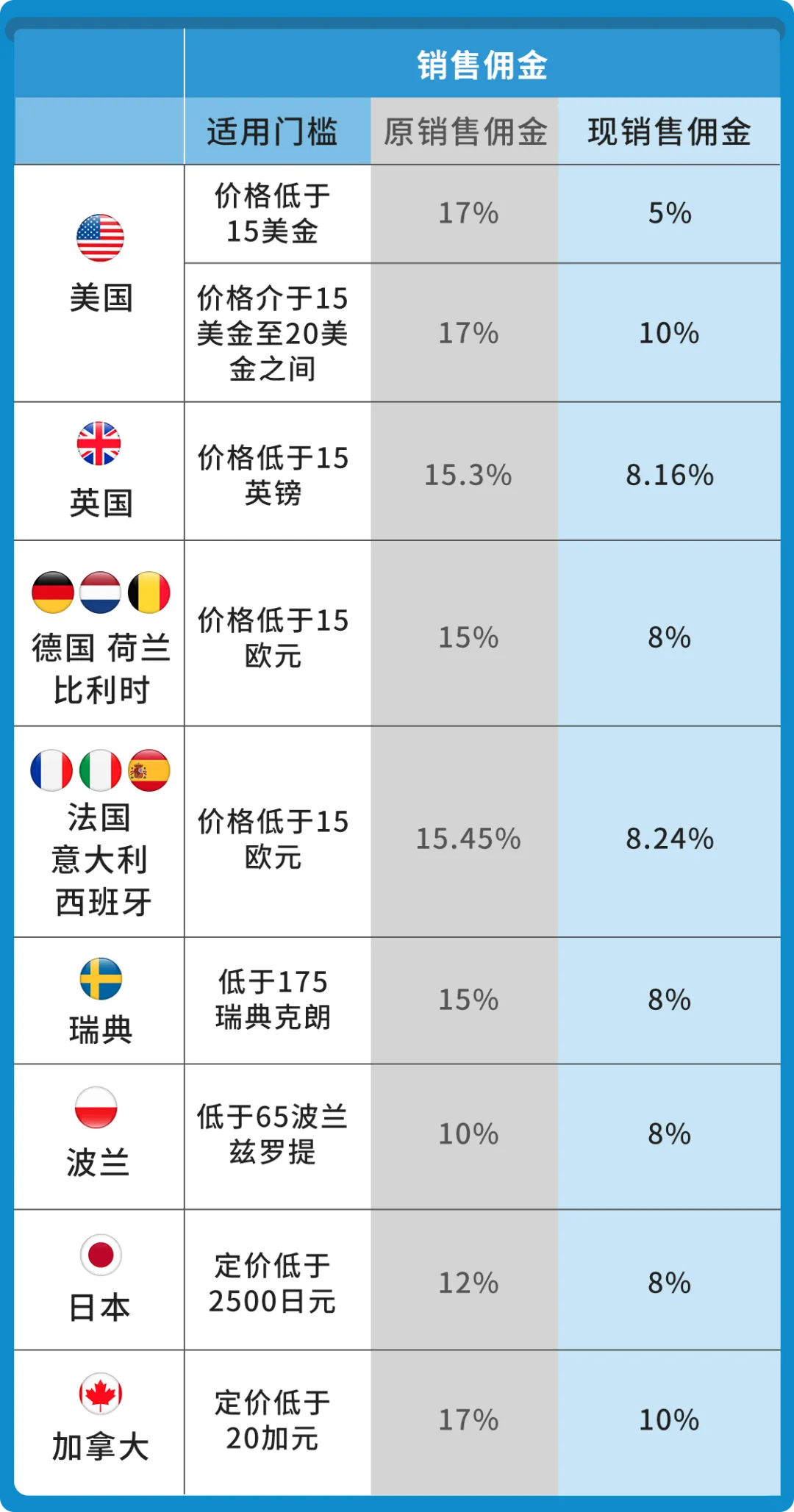

Starting from May 15 this year, Amazon began to reduce commissions for low-priced clothing products in the United States, the United Kingdom, Germany, the Netherlands, Belgium, France, Italy, Spain, Sweden, Poland, Japan, and Canada.

Previously, the commission for low-priced clothing sold below $15 was generally around 15%, and the rate for some sites could be as high as 17%. After the adjustment, the sales commission rate for this category will generally be reduced to below 10%, and the commission rate for the US site will even be reduced to 5%, becoming the lowest among all sites.

Source: Amazon

From the launch of the Low-Price Store and the reduction of commissions for low-priced clothing products, it is not difficult to see that Amazon hopes to attract more low-price sellers to settle in and regain the minds of low-price users, improving Amazon's advantage in platform price competition. Once these users attracted by other platforms return, Amazon's overall traffic will also increase further.

03 Amazon Policy Changes

1. Maintain the existing fee structure in 2025, no increase in commissions and logistics fees

Amazon stated that it will not raise the sales commission and Amazon logistics fees for the US site in 2025, nor will it introduce new types of fees. This policy has reduced a lot of pressure on sellers whose operating costs are getting higher and higher. The continuous rise of various fees over the past few years has eaten into a lot of sellers' profits.

Amazon's new commission and logistics fee policy brings certain benefits to sellers. In 2025, sellers can continue to plan their business according to the current cost at least.

2. New storage configuration fee, low inventory fee, return handling fee

Storage Configuration Fee:

On March 1, 2024, Amazon added a storage configuration fee. Amazon said that this fee is to help sellers allocate inventory to distribution centers closer to customers. Amazon Logistics will charge different levels of fees for different storage configuration options selected by sellers.

Source: Amazon

Low Inventory Fee:

On April 1, 2024, Amazon added a low inventory fee. This fee is aimed at standard-sized products whose inventory levels are consistently lower than buyer demand. In other words, if the sales turnover rate is too low, it will cause trouble for Amazon to distribute goods, affect delivery speed, and increase Amazon's distribution costs, so this fee needs to be charged.

Return Handling Fee:

Starting from June 1, 2024, Amazon will charge a return handling fee for all products with a high return rate in various categories (except for clothing and footwear, which are charged for each return). This fee only applies to products whose return rate exceeds the specific threshold for each product fee category, as shown in the figure below:

Source: Amazon

3. New coupon reporting fee

Starting from this year's Black Friday online shopping festival, Prime member exclusive discounts will charge a fee of $50. This fee will be charged at the promotion level, not at the ASIN level.

Source: Amazon

04 Amazon Listing and Store Requirements Changes

1. New requirements for Amazon listing five-point selling points

Starting from August 15, 2024, Amazon's five-point selling points have updated new requirements.

The following are the specific requirements:

Prohibit the use of special characters, such as ™, ®, €, …, †, ‡, o, ¢, £, ¥, ©, ±, ~, â, etc.

Prohibit the use of any emoji expressions

Prohibit the citation of other ASINs, or the use of descriptions such as N/A

Prohibit the use of sensitive words such as "eco-friendly, environmentally friendly, antimicrobial, antibacterial, bamboo-containing, soy-containing", etc.

Disable guarantees such as "full refund", "If not satisfied, please return it", or "unconditional guarantee, no limit", etc.

Prohibit any contact information such as company, website link, external hyperlink, etc.

Product description points cannot be repeated

There must be at least 3 five-point selling points

2. 2024 Amazon listing weight standard

Image source: Amazon

3. Amazon listing pre-compliance process

On September 30, 2024, Amazon launched the "Pre-compliance Process", which requires submitting compliance materials in advance and completing compliance review before publishing listings.

Cross-border E-commerce Excellent Craftsman School

Cross-border E-commerce Excellent Craftsman School